Art Market Analysis:

The Art Market 2014-2018

Where will the art market be headed in 2018? A question which is hard to answer - but we have tried to pull together some facts from the past four years to get a

clear picture what is actually happening in the art market and where we can expect it to move in 2018.

For the first part of our observations, we have analysed the 2014-2018 Contemporary Art and Modern/Impressionist Art Auctions at the three big global auction houses Sotheby's, Phillips, Christie's.

We will continue our Art Market report over the next days with further facts from other market categories (Old Masters etc.) and a survey of the regional auction houses. You can also expect a comparison of the performance of the three big auction houses 2014-2018; as well as some digging who were the artists that ruled the auctions in 2014-2018 and who are the artists you can expect to succeed in 2018 (yes, a George Condo report definitely coming, but there are other artists we will examine as well).

Let's start now with the 2014-2018 Contemporary Art & Modern/Impressionist Art Auctions.

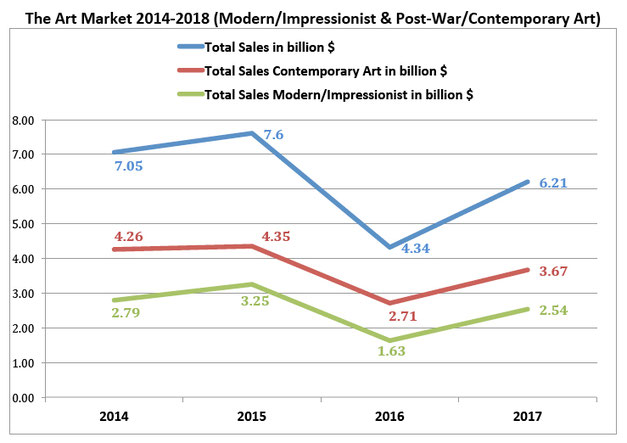

From the chart below, you can see that the much discussed market slowdown in 2016 was indeed a deep slump which cut total sales almost in half. However, on a good note, 2017 has been a year of recovery. We are still not on the levels of 2014 / 2015, but the market is in an upward spiral again, bringing total sales in 2017 back to $6.2 billion from only $4.3 billion in 2016.

From just looking superficially at the Art Market sales totals from the chart above, it may seem that there is no reason to be worried about a market recovery, and that we can expect a steady rise in 2018. But it's not that simple. Let's first try to understand what happened when the market crashed down in 2016.

Many art market commentators were talking about a healthy correction after a bubble, bringing the market back to normal levels. That could indeed be the case. But looking back at 2017 and the record prices it kept presenting us, it doesn't quite seem like there is a slowdown from the movement that keeps spiraling the prices up. For sure, the top end seems alive and kicking, doesn't it? Just think of Salvator Mundi and the Maezawa Basquiat. But think also of the Bacon masterpiece at Christie's in October that failed to find a buyer.

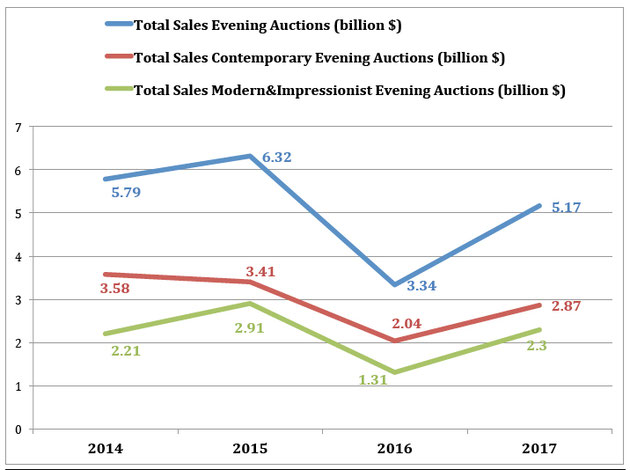

So what is actually really happening in the top end? From the chart below examining the Total sales in Evening Auctions, you can see a similar curve like the one of the Total overall Sales - only that it is interesting to note that while the Contemporary Market was already moving slightly down in 2015, the Modern & Impressionist Market had a high in that year thanks to several masterpieces coming to the market and Modern Art Collections hitting the market like the Taubman collection.

When the market came down in 2016, what actually happened is that it had been on a slight decline since 2014 and continued this trend in 2016 - only that after the

summit the Modern & Impressionist Market reached in 2015 that descent seemed a crash rather than just a steady decline.

In the top end of the market, supply is the key. There is a big hunger for the right works and for real masterpieces, but getting

them it the biggest problem. This makes the Top End Market very volatile - and its total sales as a reflection of this volatility very up and down, depending on the supply of top

works.

Moreover, it seems like the tastes of the buyers have narrowed down over the past years. There is a lot of money out there in the

world waiting to be spent on art - but the current buyers are very selective and very intent on only the very top. And they know exactly what quality is.

Especially in the Contemporary Art sector, buyers have very specific tastes; and their wishlists change quickly. Who craves a large Richter abstract today may be intent on a Basquiat tomorrow and then does not really want the Richter anymore.

On the other hand, the Top End of the Modern & Impressionist Market in 2017 is easily back to the levels of 2014. In that part of

the market, there is a common sense about what is quality, and buyers who agree to this and commit to chasing these pieces. In the Modern & Impressionist Market, if there is a masterpiece

there usually is a buyer for it. This is a market which has organically grown over many decades and most of the buyers have grown with it.

Not quite the same in the Contemporary Top End nowadays. This is a more tricky one, with less experienced and more unpredictable

buyers more relying on their personal tastes than on the common sense what a masterpiece is. It can end up with several bidders fighting over a work and pushing it to record levels - or with

nobody at all interested.

In 2018, this part of the market will very much depend on the marketing skills of the auction house experts. The Modern & Impressionist top end instead will hopefully take care of itself with the Rockefeller collection highlights hitting the auction block.

So if the Top End of the market is depending on supply and the right marketing - what is it with the rest of the Market, with all the art sold in the Day Sales; the so called Middle Market?

Can we expect this part of the market to be stable and healthy and robust, and to support the overall market? Yes and no. The Contemporary Art Middle Market seems to be doing just great, but in the Modern & Impressionist sector, the market has been heading downwards with no end in sight. Take a look at the chart below picturing the Total Sales in the Day Auctions:

Contemporary Day Sales have seen an average upward trend since 2014, with ups and downs in 2015 and 2016, but on long term an increase in total sales by 20% from 2014 to 2018.

This is caused on one hand by adding more new sales (both online and in the brick-and-mortar auction houses) and therefore increasing the number of

Post-War/Contemporary Art Day Sale lots, and on the other hand by a different kind of lots coming into these sales due to a general price shift: lots in the $800,000 to $3million price range

which 10 years ago made up for evening sale material now often also end up in the Day Sales - first because the price level in the Evening sales is much higher than 10 years ago, and second

because the middle market prices have been climbing up in the past years. The range of lots in that market segment now goes from lots by young artists in the $10,000 price range in the First Open Sales, to lots by established artists in the lower million $ price range which the auction

house specialists ruled as B-material and not worthy of Evening Sales.

So while the Post-War & Contemporary Day Sales are up and can be expected to further succeed in 2018, the Modern & Impressionist Day Auctions have

seen total sales constantly sliding down from 2014 to 2017, cutting sales more than in half and leaving a market share of only 23% to the Modern & Impressionist sector; while

Contemporary Art is making up 77% of the market share.

The crash in the Modern/Impressionist Day Sale sector shows clearly where the market in general seems to be moving: Towards the Contemporary Sector. In Modern & Impressionist Art, buyers seem to chase only the top lots and while the masterpiece market in this sector is doing very well, the average art and the middle market are fading out. Prices are down (average prices cut in half since 2014), and sell-through rates in these sales are the lowest of the market, with 20-30% of the lots in the Modern & Impressionist Day Sale auctions going unsold.

Now, where can we expect the Art Market to stand and to head in 2018? Here is a recap:

1. Total sales in Post-War & Contemporary Art and Modern & Impressionist Art are up again in 2017 after crashing down from 2015 to 2016 - so expect further recovery in 2018.

2. Sales in the Evening Sale Top End sector follow that trend and are also up again after a crash in 2016.

A further rise of sales will depend both on the quality of works coming to auction and on the marketing skills of the auctions houses.

3. The Top End is of course what makes the market spin (it makes up 86% of the total sales of the market), but it is also the part of the market where the air gets thin for most of the buyers and for many artists. This part of the market consists of only a handful of artists and an even smaller handful of their artworks chased by a relatively small amount of billionaires. And it is highly selective and unpredictable.

4. The Day Sale Middle Market sector makes up only 14% of the total sales of the art market, but when it comes to lot numbers, 85% of the total lots at auction are

Day Sale lots.

5. Day Sales are up in the Post-War & Contemporary Art sector, but down for the Modern & Impressionist Day Sales. Expect Post-War & Contemporary Art Day

Sales to further florish in 2018, but Modern & Impressionist Day Sales to suffer.

6. The Top End of the Market sees a hunger both for Modern & Impressionist Art as for Post-War & Contemporary Art pieces. But the Middle Market is decidedly

shifting towards Post-War & Contemporary Art. This is where the action is happening, while the Modern & Impressionist Middle Market is facing hard times and might not be on an easy

recovery path.

7. As a result, what we have witnessed over the past four years is not really a crash, a correction or a slowdown of the market - it is a market that has been

narrowing down and become very selective. Where 5-10 years ago, buyer's tastes covered all kind of artists and artworks, today it is a hunt for what is perceived to be the best pieces by

only a handful of selected artists which are considered top material. Record prices are paid for these pieces, but the rest of the market and the not A, but B & C material is struggling. And

this leads to segments like the Modern & Impressionist Day Sale art to slowly fade out over the years, and if there is no turn-back from this trend, then we can expect these market areas to

disappear into meaninglessness - like the smaller and middle-sized galleries all over the world who are fighting hard to not having to close their galleries.

Art Market 2014 2015 2016 2017 Art Market Analysis Report Total Sales Evening Sales Day Sales Top End Middle Market prices auctions christies sothebys phillips