Auction House Performance 2014-2018

In our Art Market 2014-2018 report, we analysed how the Art Market for Modern/Impressionist and Post-War / Contemporary Art developed over the last four years from 2014-2018.

The question is now, how did the individual auction houses perform over these years? Are there winners and losers, or did they all show an equal performance?

We will start with a comparison of the three big global auction houses and continue this research in the next days by digging into the numbers of the smaller and regional auction houses.

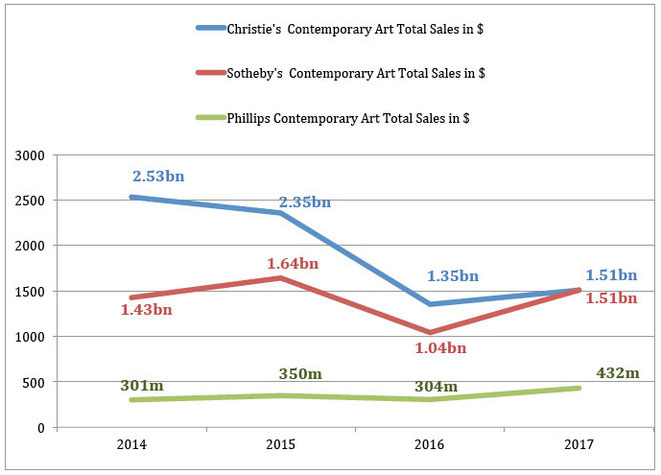

You can see from the chart above exploring total sales in Contemporary Art at Christie's, Sotheby's and Phillips from 2014 - 2017 that a kind of equalization between the houses is happening, with Christie's clearly loosing its market leadership position, Sotheby's pushing total sales to be on level with Christie's, and Phillips increasingly claiming their share of the market.

On a long-term strategy, Phillips and Sotheby's both see a more or less accentuated growth in total sales from 2014-2017 (Phillips +44% / Sotheby's +6%).

Christie's is the only one who saw its sale crash from 2015 to 2016 and did not recover from that crash. Their total sales in Contemporary Art are down by 40% from 2014-2017.

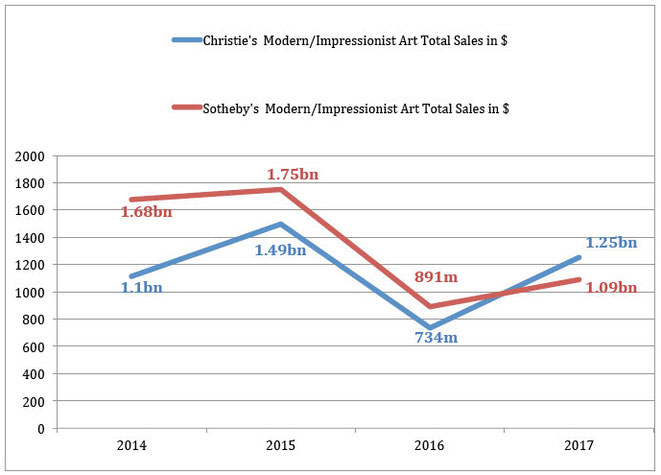

The picture looks different in the Modern/Impressionist Art Department. Here it is Sotheby's who started out as market leader and who lost market share from 2014-2017 (sales down by 35%); while Christie's total sales in that category saw a long-term increase by 15% (with a peak in 2015 and a crash in 2016).

Again, we see a certain tendency to equalization between the houses, but here it is Christie's clearly taking the market leader position from Sotheby's.

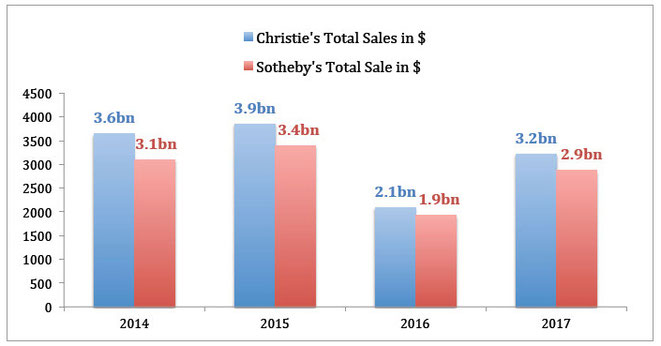

In the bigger picture, if you consider the combined sales totals of Modern/Impressionist and Contemporary Art, it has been and still is Christie's who is leading the market over Sotheby's - in the years 2014, 2015 and 2016 because of their domincance in the Contemporary Art Market and in 2017 because they managed to overhaul Sotheby's in the Modern/Impressionist category.

What could be the auction houses strategy for 2018, if we reflect 2014-2017?

>> For Phillips, the only way is up right now. They have been continuously building up their sales by increasing the number of sold lots over the years, but more important by being able to get more valuable consignments and hence increase the average price of their lots by 35%, including but not limited to introducing Modern Art lots into their sales.

We can expect them to continue this strategy successfully in 2018.

>> Sotheby's have been pushing their total sales in the Contemporary sector, but lost share in the Modern/Impressionist department.

>> Christie's was able to snatch and successfully sell several masterpiece Modern/Impressionist Art lots in 2017 which resulted in them taking the market leadership from Sotheby's - but they lost their dominant position in the Contemporary Art sector.

>> Sotheby's gained track in the Contemporary sector not so much by securing and selling blue-chip masterpieces, but by building up their Day Sale sales, and by both increasing the total sales as the average price of the lots in that department.

Expect them to 1. continue this strategy to strengthen the Contemporary Art Day Sale /Middle Market sector; 2. to try to get back their foot into becoming market leaders again in the masterpiece Modern/Impressionist market; and 3. to try to increase their market share in the Contemporary Art masterpiece sector.

>> Christie's will be pushing the Modern/Impressionist masterpiece market not least because of the prized Rockefeller collection they have on consignment. But expect them to try full force to get back to where they were in the Contemporary Art Market, by both pushing the masterpiece sector and trying to gear up their day sales.

Especially in the Day sales, they have the chance to change their strategy from just pushing up the lot numbers to also building up the price levels.

The average price in their Contemporary Art Day Sales fell from $121,000 to $98,000 (where Sotheby's managed to push their Contemporary Art Day Sales average prices up from $95,000 to $118,000; and Phillips from $39,000 to $53,000). There is room for improvement there.

In general, a lot always depends on which top lots the houses will be able to secure over the year. But as an overall strategy we can observe that while 2014 and 2015 were years where big prices just kept hammering down and a large number of masterpieces both in Modern/Impressionist as in Contemporary Art came to the market, 2016 left the auction houses with a big problem of supply overall in the top end but also in the Day Sale market (who is always following the top end).

For 2017, the auction houses set on a strategy to get in as much lots as possible in the Contemporary Art sector - and this strategy paid out. It also helped them to broaden their base both of artists as price levels.

This approach will also help them to succeed in 2018: if supply in the top end is a problem and the market has become too selective, increase your number of lots and try to broaden the base both of artists and lots offered as of collectors approached. And at the same time (this is what we learned from the stellar da Vinci sale), put all your marketing efforts into the top lots you have.

And this is where Christie's has proven to be on top and we will see if they continue to take the lead on marketing lots, or if Sotheby's and Phillips learned their lessons and will follow with their own strategies in 2018.

Auction Houses Auction House Performance Market Art Market Report Sotheby's Sothebys Christies Christie's Phillips Total Sales